With the release of Donald Trump’s detailed spending plan last week, we make a preliminary analysis of how both of the leading presidential candidates’ plans will help or hurt cities.

Tax-exempt municipal bonds are the primary way state and local governments finance the kinds of infrastructure that support everyday life and robust local economies – and, unfortunately, both of the leading presidential candidates support measures to cap or eliminate them. (Getty Images)

This post was co-authored by Carolyn Berndt, Matthew Colvin and Angelina Panettieri.

First, the good news. Both Secretary Clinton and Donald Trump’s infrastructure plans recognize that there is a huge investment needs gap between the available funding and financing to improve our nation’s transportation, water and broadband infrastructure and what it will actually take to maintain, upgrade, and build infrastructure systems to keep America competitive in the 21st century. Both Secretary Clinton and Mr. Trump have called for significant spending packages to help close that gap – $500 billion and $1 trillion, respectively. It is also good news that both camps recognize the value that infrastructure investments play in growing local and national economies and creating the kinds of communities where families want to live and businesses want to invest.

Funding Levels and Pay-fors

Secretary Clinton’s plan calls for $250 billion in direct public investment, along with $25 billion to establish a national infrastructure bank, which will generate an additional $225 billion in financing. Mr. Trump’s plan, prepared by two senior advisors, calls for a national version of tax increment financing, which will leverage $1 trillion in private sector investment and will be paid for with incremental tax revenue resulting from the projects.

Both Plans Put Tax-Exempt Municipal Bonds at Risk

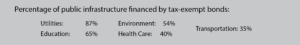

Unfortunately, Secretary Clinton has expressed support for capping tax-exempt municipal bonds and turning to alternatives like the Build America Bond Program, and Mr. Trump has proposed eliminating them entirely, which should be very troubling for cities. Tax-exempt municipal bonds are the primary way state and local governments finance the kinds of infrastructure that support everyday life and robust local economies. From the construction of schools and hospitals to ensuring access to clean water and safe roads, cities large and small use tax-exempt municipal bonds to save on interest cost while still finding ways to provide critical services to their local communities (read more about the vital role tax-exempt municipal bonds play in cities here).

The next president must maintain the federal income tax exemption for municipal bonds to protect this critical tool for local governments to rebuild and improve America’s infrastructure.

Infrastructure Gap Can’t be Overcome with Private Sector Financing Alone

A recent NLC report, “Paying for Local Infrastructure in a New Era of Federalism,” looks at the ability of cities to address the nation’s growing infrastructure challenges. The costs of building, operating and maintaining road, transit and water/wastewater systems are falling increasingly to local governments with the decline of state and federal funding, an increase in mandates and a misalignment of priorities. In this era of “new federalism,” local governments have assumed a greater responsibility to meet their infrastructure needs, but much of this devolution of responsibility has come without authority to raise funds locally.

There are a number of challenges associated with implementing public-private partnerships (P3s) in the United States. The report finds that only 32 states authorize public-private partnerships, and only 13 of those states authorize the use of P3s for all types of infrastructure. What’s more, we have very little experience as a nation with implementing P3s. While we should absolutely continue exploring solutions that can help finance projects, deliver private sector innovations and reduce risk to local governments, our infrastructure needs are immediate and will not wait for us to build the expertise required to implement P3s on a national scale.

Infrastructure Banks Put Water Projects at a Disadvantage

Infrastructure banks sound good on paper – and for some projects, they may be. The problem with Secretary Clinton’s $25 billion national infrastructure bank proposal is that it pits all types of infrastructure projects against one another. Without set-asides based on categories of infrastructure, the reality is that water, energy and broadband projects will likely lose out to transportation projects. In many cases, funding would go to projects that are presumed to be the most important or of regional or national significance. The design of an infrastructure bank with regard to project selection would be critically important to ensure that all geographic regions of the country benefit, along with all types of projects.

Broadband Plans Could Preempt Local Authority

Clinton and Trump differ most sharply on whether they view broadband as an infrastructure opportunity or a threat. Clinton’s broadband policy outlines positions on technology workforce development, investment in broadband infrastructure, internet governance, and cybersecurity that build on many current Obama administration initiatives. The Trump campaign has a more defensive posture focusing on cybersecurity, and, unlike Clinton, has explicitly called for an intergovernmental task force to coordinate federal, state, and local government responses to cyber threats. Outside of cybersecurity, the Trump campaign has been largely silent on digital infrastructure.

Clinton has proposed a “Model Digital Communities” competitive grant program to incentivize streamlined local permitting processes, “dig once” and “climb once” policies to minimize expense and time needed to access public rights of way, and public-private partnerships to expand broadband access. Clinton’s proposals also prioritize the deployment of a civic Internet of Things and a 5G wireless network. These proposals could support innovative local efforts to close the digital divide in their communities and create cutting edge infrastructure – provided they remain voluntary incentive programs.

“Dig once” and “climb once” policy promotion could also help communities experiment and innovate efficiently – or it could hamstring local authority if done through one-size-fits-all mandate. A Clinton plan to accelerate wireless deployment and minimize barriers to development could come at the cost of local zoning and planning authority, if regulators rush to assist wireless providers in superseding local review to place the thousands of small-cell facilities needed to “densify” networks, particularly in urban areas. The next president must work with local governments to promote wired and wireless broadband development without stripping them of their most basic authority to govern their rights-of-way and the placement of infrastructure in their communities.

About the authors:

Carolyn Berndt is the Program Director for Infrastructure and Sustainability on the NLC Federal Advocacy team. She leads NLC’s advocacy, regulatory, and policy efforts on energy and environmental issues, including water infrastructure and financing, air and water quality, climate change, and energy efficiency. Follow Carolyn on Twitter at @BerndtCarolyn.

Carolyn Berndt is the Program Director for Infrastructure and Sustainability on the NLC Federal Advocacy team. She leads NLC’s advocacy, regulatory, and policy efforts on energy and environmental issues, including water infrastructure and financing, air and water quality, climate change, and energy efficiency. Follow Carolyn on Twitter at @BerndtCarolyn.

Matthew Colvin is the Principal Associate for Infrastructure and Development on the NLC Federal Advocacy team. He leads NLC’s advocacy, regulatory, and policy efforts on surface, air and marine transportation issues. Follow Matthew on Twitter at @MatthewAColvin.

Matthew Colvin is the Principal Associate for Infrastructure and Development on the NLC Federal Advocacy team. He leads NLC’s advocacy, regulatory, and policy efforts on surface, air and marine transportation issues. Follow Matthew on Twitter at @MatthewAColvin.

Angelina Panettieri is the Principal Associate for Technology and Communication at the National League of Cities. Follower her on twitter at @AngelinainDC.

Angelina Panettieri is the Principal Associate for Technology and Communication at the National League of Cities. Follower her on twitter at @AngelinainDC.